Your Business Starts Here

You’ve probably heard incorporation procedures in Switzerland can be complicated. We can prove you the opposite: with our online company registration procedure you can get your business venture up and running fast and effortlessly.

Limited company? Sole trader? New to Switzerland?

Swiss Company

Incorporation of an LLC or LTD/PLC in Switzerland

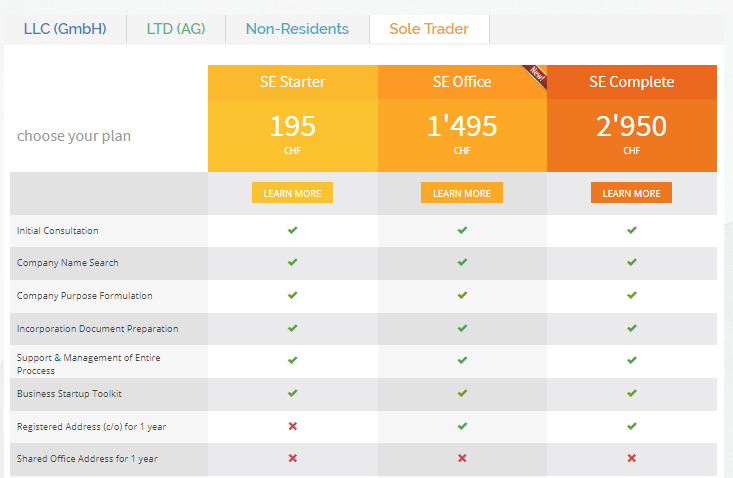

Self-Employment

Register as sole trader in Switzerland

Swiss Office

Get registered address or shared office for your business

Accounting

Accounting for your business of any size

Swiss Limited Company

from CHF 495

Our ‘Basic Package’ is the fastest and the most cost-effective way to start your business in Switzerland. With no complicated paperwork and in as little as 5 minutes, you can order the Basic package online and start the incorporation immediately.

With a StartUp or Comprehensive Package, a registered office address or a shared office address in the most popular business location in the whole of Switzerland. You are welcome to one of the most tax efficient Cantons. Modern office conditions and mail forwarding included.

Self-Employment

from CHF 195

This may be your first step to start working independently. This legal form is perfect for first-time enterpreneurs and small businesses. It has no minimum capital requirement and comparatively easy formalities. However, you still need to make sure that you are registered and conduct business legally correct, due to the personal liability.

With our ‘SE Starter’ Package, for only CHF 195 you can enjoy the benefits of self-employment without worrying about the formalities.

Questions? Need Help?

Chat to us

Skype: Gamut Corporate, Live: gamutcorporate

Good Reasons to Register Your Business in Switzerland

Switzerland is Great for Business

- Swiss political & financial stability

- Swiss market (Swiss customer deal with local entities)

- Competitive taxation compared with most countries

- Swiss presence – building image & trust worldwide

- Data privacy.

Your Swiss Partner

- Efficient online service & offline personal support

- Years of business expererience

- Knowledge of Swiss legislation and processes

- Our favourable central location (in a tax efficient Canton of Zug)

- Generous offers at competitive pricing